When it comes to moving money, understanding the differences between various transfer methods is crucial. This article explores two common electronic transfer options: ACH transfers and wire transfers. We’ll delve into the specifics of each, highlighting the advantages and disadvantages of both ACH and wire transfer systems. By comparing processing times, fees, security measures, and typical use cases, you’ll be empowered to choose the most appropriate method for your financial needs, whether for business or personal transactions. Deciding between an ACH transfer and a wire transfer depends on various factors, which we will examine closely.

This comparison of ACH transfers versus wire transfers will cover key aspects such as transfer speed, cost-effectiveness, and security protocols. We will clarify when it’s best to use an ACH transfer, such as for recurring payments or payroll direct deposit, and when a wire transfer is the more suitable option, such as for time-sensitive, large-sum transactions. Understanding the distinctions between these two transfer methods will allow you to make informed decisions about managing your finances efficiently and securely. By the end of this article, you will be able to confidently distinguish between an ACH payment and a wire transfer and choose the best option for your specific situation.

What Is an ACH Transfer?

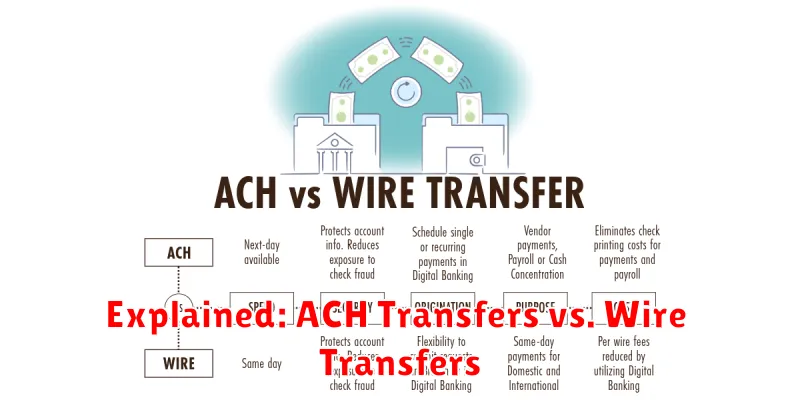

An ACH transfer is an electronic funds transfer made through the Automated Clearing House (ACH) network. This network processes large volumes of low-value transactions in batches. ACH transfers are typically used for recurring payments like direct deposits, bill payments, and online purchases. They are known for being cost-effective and widely accessible, but generally take one to three business days to process.

How Wire Transfers Differ

Wire transfers distinguish themselves through a few key characteristics. They are typically faster than ACH transfers, often completing on the same business day. This speed comes at a higher cost. Wire transfers are also irrevocable, meaning once sent, the funds cannot be retrieved easily. They offer a higher degree of certainty regarding delivery times compared to ACH. Finally, wire transfers often accommodate larger sums of money.

Which Is Faster and Safer?

When it comes to speed, wire transfers are the clear winner. They are processed almost instantly, sometimes within the same day. ACH transfers, on the other hand, can take several business days to complete.

Regarding safety, both methods offer security. However, wire transfers are generally considered slightly safer due to their irrevocable nature. Once a wire transfer is sent, it’s very difficult to reverse. This makes them less susceptible to fraud. While ACH transfers can be reversed in cases of unauthorized transactions, the process can be time-consuming.

Fee Comparison

A key difference between ACH and wire transfers lies in the associated fees. ACH transfers are typically less expensive, sometimes even free, depending on the financial institution. This makes them attractive for recurring transactions and smaller payments.

Wire transfers, on the other hand, generally incur higher fees, both for sending and receiving. These fees can vary based on the bank and whether the transfer is domestic or international.

When to Use Each Method

Choosing between ACH and wire transfers depends on your specific needs. ACH transfers are ideal for recurring payments, such as bill pay or direct deposit, due to their lower cost. They are also suitable for non-urgent transactions where a few business days processing time is acceptable.

Wire transfers are best suited for time-sensitive transactions requiring immediate availability of funds, such as real estate closings or emergency payments. Although they come with higher fees, their speed and finality make them the preferred choice for urgent, high-value transfers.

How to Set Up Transfers in Digital Apps

Setting up transfers within digital banking or payment apps generally involves a few key steps. First, you’ll need to add and verify the recipient’s banking information, which typically includes their bank’s routing number and their account number. For some apps, linking external accounts via Plaid or similar services may be an option.

Next, specify the transfer amount. Depending on the app and transfer type, you may encounter transfer limits. Finally, review the transfer details and authorize the transaction. It’s crucial to always double-check the recipient’s information to avoid sending money to the wrong account. Processing times vary depending on the transfer method (ACH or Wire) and the financial institution.

International Use and Restrictions

ACH transfers are primarily designed for domestic use within the United States. International ACH transactions are limited and typically involve specific partnerships between banks in different countries. Therefore, they are not a readily available option for cross-border payments.

Wire transfers, on the other hand, are commonly used for international transactions. They offer a more straightforward and readily available method for sending and receiving money across borders. However, they are generally more expensive than domestic wire transfers due to added fees and currency conversion charges.