The financial landscape is rapidly evolving, with digital banking transforming how we manage our finances. This transformation is largely powered by the innovative capabilities of cloud technology. From enhanced security measures to personalized customer experiences, cloud computing provides the infrastructure necessary for digital banks to thrive in today’s competitive market. Understanding how cloud technology empowers digital banking is crucial for both financial institutions and consumers alike. This article explores the key ways cloud solutions are revolutionizing the digital banking experience, paving the way for a more efficient, secure, and accessible financial future.

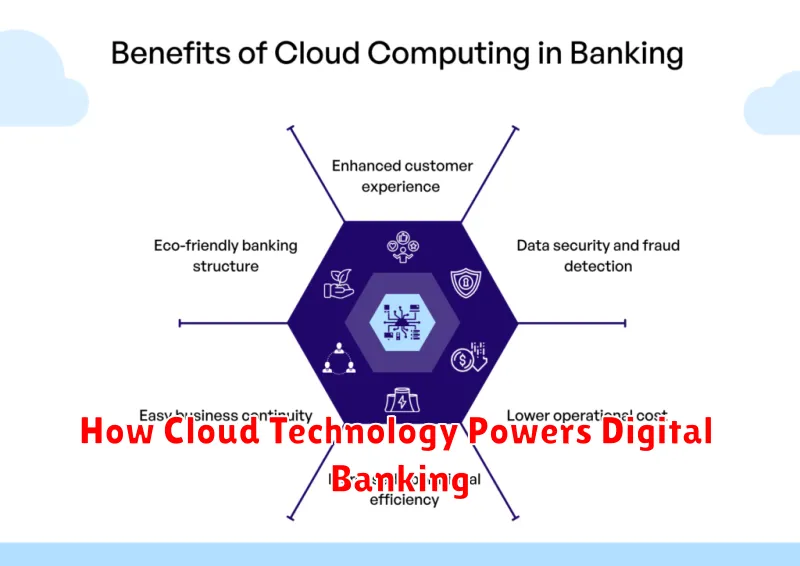

Cloud-based banking offers a range of benefits, including improved scalability, reduced costs, and enhanced data analytics. By leveraging the power of the cloud, digital banks can streamline operations, offer innovative financial products, and personalize customer interactions. This article will delve into the specific cloud technologies driving this transformation, examining the impact on areas such as core banking systems, customer relationship management (CRM), and fraud detection. Discover how cloud-powered digital banking is shaping the future of finance and creating new possibilities for both individuals and businesses.

What Is Cloud Technology?

Cloud technology delivers computing services—including servers, storage, databases, networking, software, analytics, and intelligence—over the Internet (“the cloud”). Instead of owning and maintaining physical data centers and servers, organizations can access these services on an as-needed basis from a cloud provider like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud.

Key benefits of cloud technology include cost savings, increased scalability, and enhanced flexibility. Businesses can scale their computing resources up or down quickly to meet changing demands without large upfront investments in hardware. This allows them to focus on core business operations rather than IT management.

Why Digital Banks Use the Cloud

Digital banks leverage cloud technology for several key advantages. The cloud offers scalability, allowing them to easily adjust resources to meet fluctuating customer demands. This flexibility translates to cost-effectiveness, eliminating the need for extensive physical infrastructure.

Enhanced security measures provided by established cloud providers strengthen customer data protection. Furthermore, the cloud enables faster innovation through rapid deployment of new features and services, keeping digital banks competitive in a fast-paced market.

Scalability and Cost Efficiency

Cloud technology offers digital banking a significant advantage in terms of scalability. Banks can easily adjust their computing resources to meet fluctuating demands, whether it’s a sudden surge in transactions or seasonal variations in customer activity. This eliminates the need for large upfront investments in hardware and allows banks to pay only for the resources they consume.

This on-demand model translates directly into cost efficiency. By avoiding the costs associated with maintaining and upgrading physical infrastructure, banks can significantly reduce their operational expenses. This allows them to allocate resources to other critical areas, such as innovation and customer service.

Security and Real-Time Backups

Cloud technology significantly enhances the security of digital banking. Data encryption both in transit and at rest protects sensitive customer information.

Real-time backups ensure data redundancy and business continuity. In the event of a system failure or cyberattack, data can be quickly restored, minimizing downtime and financial losses.

Benefits to End Users

Cloud technology offers numerous advantages to digital banking customers. Increased accessibility allows users to manage finances anytime, anywhere, through various devices. Enhanced security measures implemented by cloud providers protect sensitive data more effectively than traditional systems.

Faster transaction speeds are another benefit, enabling near-instantaneous payments and transfers. Additionally, cloud-based platforms offer personalized experiences, tailoring services to individual needs. Finally, the scalability of cloud solutions ensures banks can adapt to growing customer demands and offer a wider range of services.

Cloud vs. Traditional Server Infrastructure

Choosing between cloud and traditional server infrastructure is a critical decision for banks undergoing digital transformation. Traditional infrastructure involves owning and managing physical servers and data centers. This requires significant upfront investment and ongoing maintenance. In contrast, cloud infrastructure leverages the resources of a third-party provider, offering scalability and flexibility.

With cloud computing, banks can quickly adapt to changing demands, paying only for the resources consumed. This reduces capital expenditure and allows for faster deployment of new services. However, security and compliance remain crucial considerations when migrating sensitive financial data to the cloud.

Future Innovations in Cloud Banking

The future of cloud banking promises further advancements in several key areas. Serverless computing will optimize resource allocation, enhancing efficiency and scalability. Edge computing will bring data processing closer to the user, enabling faster and more responsive services, particularly beneficial for real-time transactions and personalized experiences.

Artificial intelligence (AI) and machine learning (ML) will play increasingly important roles. AI-powered chatbots will offer seamless customer support, while ML algorithms will further refine fraud detection and risk management. The integration of blockchain technology may revolutionize security and transparency within financial transactions.