In today’s rapidly evolving financial landscape, digital banking has become the preferred mode of managing finances for millions. Understanding the digital bank verification process is crucial for both security and seamless access to your funds. This article provides a comprehensive overview of the various verification methods employed by digital banks, ensuring you are well-informed about how your identity and financial information are protected.

From multi-factor authentication and biometric verification to knowledge-based authentication and device recognition, we will explore the key components of the digital bank verification process. Gaining a strong understanding of these processes is paramount to mitigating risk and enjoying the full benefits of online banking and digital finance with confidence.

Why Verification Is Necessary

Verification is a critical component of the digital banking process. It ensures the security of your account and helps protect you from fraud. By verifying your identity, digital banks can confirm that you are who you claim to be, preventing unauthorized access and transactions.

This process also aids in complying with regulatory requirements designed to combat money laundering and other illicit activities. Verification helps maintain the integrity of the financial system as a whole.

What You’ll Need to Provide

The digital bank verification process requires specific information to confirm your identity and comply with regulations. Generally, you’ll need to provide a government-issued photo ID, such as a driver’s license or passport.

Additionally, you may be asked for proof of address. Acceptable documents typically include utility bills, bank statements, or official correspondence displaying your current address. Some banks may also require your Social Security number (SSN) or other identifying information for verification purposes. The specific requirements may vary depending on the bank and the type of account you are opening.

KYC and AML Regulations Explained

Know Your Customer (KYC) regulations require financial institutions to verify the identities of their customers. This helps prevent financial crimes like identity theft and fraud. KYC processes typically involve collecting and verifying identifying information, such as government-issued IDs and proof of address.

Anti-Money Laundering (AML) regulations are designed to prevent criminals from disguising illegally obtained funds as legitimate income. AML compliance involves monitoring customer transactions and reporting suspicious activity to the authorities. These regulations help maintain the integrity of the financial system.

How Long the Process Takes

The digital bank verification process timeframe can vary depending on several factors. Individual bank policies play a significant role, with some institutions boasting near-instantaneous approval while others may take a few business days. The complexity of your application also contributes, as more intricate financial situations may require additional review. Finally, the volume of applications being processed at any given time can impact overall processing speed.

While specific timeframes are difficult to provide, most verifications are typically completed within one to three business days.

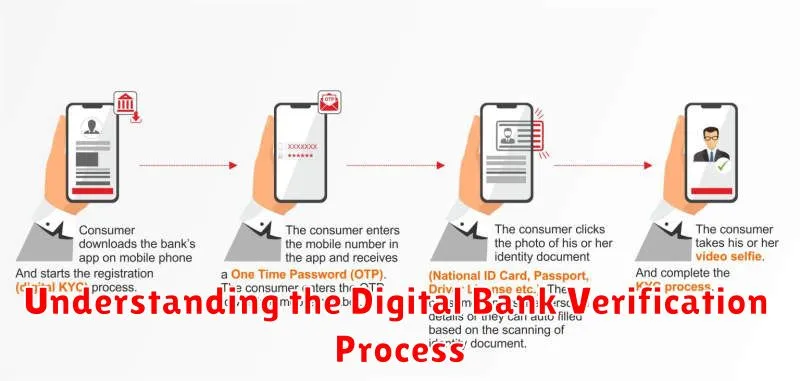

Using Document Scanning via App

Many digital banks utilize in-app document scanning for identity verification. This process requires users to scan their government-issued IDs, such as a driver’s license or passport, directly through the bank’s mobile application.

The app typically uses the device’s camera to capture an image of the document. Optical Character Recognition (OCR) technology then extracts relevant data, like name, address, and date of birth. This automated data extraction significantly streamlines the verification process.

Ensuring clear images is crucial for accurate OCR reading and successful verification. The app may provide guidelines for optimal image capture, such as proper lighting and document positioning.

What to Do If Rejected

Rejection during the digital bank verification process can be frustrating, but it’s not necessarily the end of the road. Carefully review the rejection notice for specific reasons.

Common issues include incorrect information, insufficient documentation, or failing to meet eligibility criteria. Double-check all details for accuracy and resubmit your application if possible. Contacting customer support can provide further clarification and guidance for the next steps.

Consider exploring alternative banks or financial institutions if the issue cannot be resolved.

Keeping Your Identity Safe

Protecting your identity is crucial in today’s digital landscape. During the bank verification process, you’ll be asked to share personal information. It’s vital to ensure you’re interacting with legitimate institutions.

Be wary of unsolicited requests for sensitive data like your social security number or full account details. Legitimate banks rarely ask for this information via email or unsolicited phone calls.

Strong passwords and two-factor authentication are essential safeguards. Regularly monitor your accounts for suspicious activity and report any unauthorized access immediately.