In today’s rapidly evolving financial landscape, the emergence of neobanks presents a compelling alternative to traditional banks. This article delves into the key differences between these two banking models, providing a comprehensive understanding of their respective advantages and disadvantages. Choosing the right banking partner is a crucial financial decision, and understanding the nuances of neobanks vs. traditional banks will empower you to make an informed choice tailored to your specific needs. We’ll explore features, fees, security measures, and the overall customer experience offered by both traditional banking institutions and their digital counterparts, the neobanks.

Are you considering switching to a neobank or sticking with your traditional bank? This comparative analysis will equip you with the knowledge necessary to navigate the complexities of modern banking. We’ll examine the core functionalities of both neobanks and traditional banks, focusing on critical aspects such as account access, customer service, and the range of financial products available. By understanding the strengths and weaknesses of each model, you can determine which option aligns best with your financial goals and preferences. This detailed comparison of neobanks vs. traditional banks will shed light on the evolving world of finance and help you make a well-informed decision.

What Is a Neobank?

A neobank is a digital bank that operates exclusively online without traditional physical branch networks. They offer services via mobile apps and web platforms, providing customers with 24/7 access to their accounts.

Neobanks often focus on providing innovative financial services and user-friendly interfaces, aiming to streamline traditional banking processes. They frequently target specific demographics, such as tech-savvy individuals or small businesses, with tailored product offerings.

While some neobanks operate independently, others partner with traditional banks to provide regulated financial products and services. This partnership allows them to leverage the existing banking infrastructure while delivering a more modern, digital banking experience.

Key Differences from Traditional Banks

Neobanks distinguish themselves from traditional banks in several key ways. Primarily, neobanks operate exclusively online, lacking physical branches. This digital focus often translates to lower overhead costs, potentially leading to better interest rates and lower fees for customers.

Furthermore, neobanks frequently emphasize tech-driven features like user-friendly mobile apps, budgeting tools, and real-time spending notifications. While traditional banks are increasingly adopting similar technologies, neobanks often lead in innovation and user experience.

Finally, in terms of regulation, neobanks often partner with established financial institutions, leveraging their existing licenses and infrastructure. This approach allows them to offer regulated banking services while maintaining a nimble, tech-focused operational model.

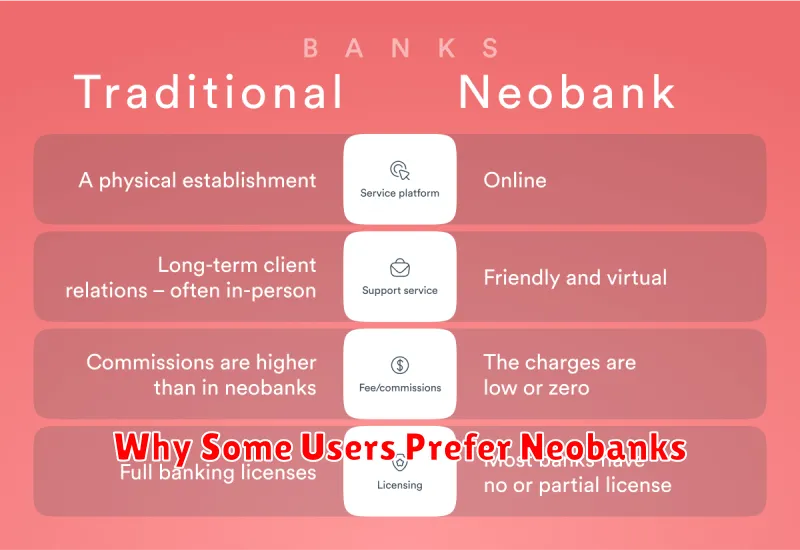

Why Some Users Prefer Neobanks

Neobanks often attract users due to their digital-first approach and emphasis on technology. This translates to streamlined account opening, intuitive mobile apps, and 24/7 account access.

Lower fees are another significant draw. Neobanks frequently offer free basic accounts and charge less for international transactions and overdrafts, appealing to cost-conscious consumers.

Finally, some users find neobanks more transparent and customer-centric, with features like personalized budgeting tools and real-time spending notifications.

Fee Structures and User Experience

A key differentiator between neobanks and traditional banks lies in their fee structures and user experience. Neobanks often boast lower fees, sometimes eliminating monthly maintenance fees, overdraft fees, and international transaction fees altogether. This cost-effectiveness stems from their digital-first model, reducing overhead costs associated with physical branches.

User experience is another area where neobanks typically excel. Their mobile-first design and intuitive interfaces provide a seamless and user-friendly banking experience. Traditional banks, while adapting to digital platforms, often maintain legacy systems that can feel clunky and less user-friendly in comparison.

Are Neobanks Safe?

Security is a primary concern for many considering a neobank. While neobanks generally offer similar security measures to traditional banks, like encryption and two-factor authentication, it’s important to understand the nuances.

Many neobanks partner with established banks to provide FDIC insurance (in the US) or equivalent deposit protection in other regions. This means your deposits are typically protected up to $250,000 per depositor, per insured bank, for each account ownership category. It is crucial to confirm that your chosen neobank offers this protection.

Additionally, be aware that some neobanks operate exclusively online, lacking physical branches. This can impact account access during website outages. Understanding how your neobank handles such scenarios is essential.

Who Regulates Neobanks?

Neobanks themselves are not directly regulated as banks. Instead, they partner with traditional, FDIC-insured banks. This partnership allows them to offer banking services while operating under the existing bank’s regulatory umbrella.

This means that the Office of the Comptroller of the Currency (OCC), the Federal Reserve, and the FDIC, who regulate traditional banks, indirectly regulate neobanks through their partner institutions. Customer deposits held in partner banks are typically insured up to $250,000 per depositor, per insured bank.

What Services Are Still Missing?

While neobanks offer many advantages, some services remain underdeveloped or unavailable. Complex financial products such as mortgages and sophisticated investment options are often lacking. Physical branch access can be a significant drawback for customers who prefer in-person banking. Furthermore, certain business banking services are typically limited, hindering neobank adoption by larger corporations.

Check cashing, a crucial service for some, may not be readily available. Similarly, certain international banking services such as wire transfers can be more complex or expensive through a neobank. It’s crucial to carefully assess your individual banking needs and compare available services before switching to a neobank.