In today’s increasingly digital world, managing finances often revolves around online banking and digital transactions. While this offers convenience, it also presents the risk of overdrafts, which can lead to unexpected fees and financial strain. This article explores practical tips and strategies to effectively reduce overdraft risks in digital banking and maintain healthy financial habits.

Navigating the intricacies of digital banking requires vigilance and proactive measures to avoid costly overdrafts. From setting up account alerts to employing budgeting apps, understanding the available tools and implementing effective strategies can significantly reduce overdraft risks and empower you to take control of your finances. This guide will provide valuable insights into managing your accounts effectively and avoiding the pitfalls of digital banking overdrafts.

What Causes an Overdraft?

An overdraft occurs when you attempt to withdraw or make a payment exceeding your available account balance. Several common transactions can trigger an overdraft.

Checks: Presenting a check for an amount greater than your balance can lead to an overdraft. ATM withdrawals: Attempting to withdraw cash beyond your available funds will also result in an overdraft. Debit card purchases: Using your debit card for purchases exceeding your account balance, including online transactions and recurring payments, can cause an overdraft.

Electronic payments and transfers: Scheduled bill payments or online transfers initiated when insufficient funds are available can result in overdrafts. Bank fees: Be mindful that certain bank fees, such as monthly maintenance fees or overdraft fees themselves, can push your account balance below zero, triggering an overdraft.

Tracking Balance in Real-Time

One of the most effective ways to mitigate overdraft risks is through real-time balance tracking. Digital banking platforms often provide this feature, allowing you to instantly view your available funds.

By monitoring your balance frequently, you can make informed spending decisions and avoid transactions that could lead to overdrafts. Setting up balance alerts can provide an extra layer of security, notifying you when your account reaches a specified threshold.

Setting Alerts and Limits

Proactive alerts are crucial in managing your account balance. Set up low-balance alerts to receive notifications when your funds dip below a specified threshold. This gives you time to transfer funds or adjust spending to avoid overdrafts.

Similarly, consider setting transaction limits. This restricts the amount of money that can be withdrawn or spent within a given timeframe. Daily or weekly limits can act as safeguards against excessive spending and potential overdrafts.

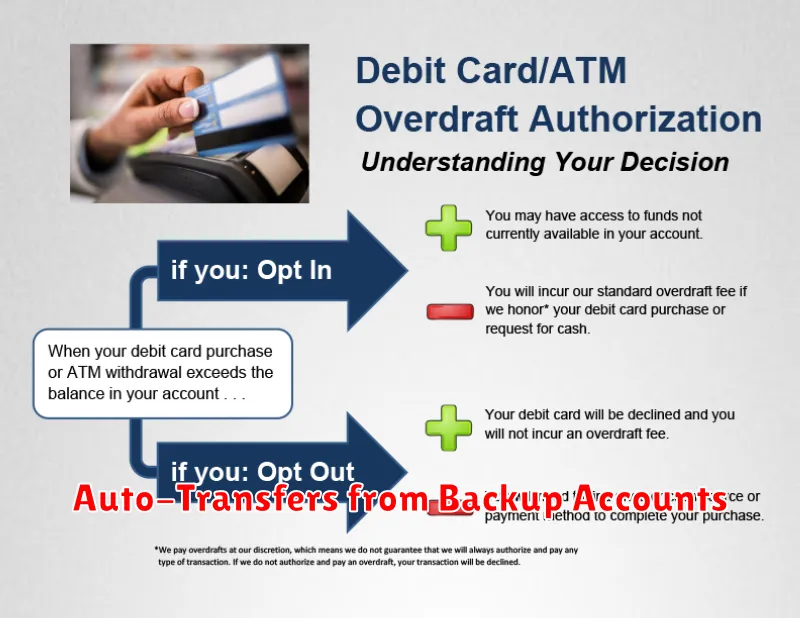

Auto-Transfers from Backup Accounts

One of the most effective ways to avoid overdrafts is to set up automatic transfers from a linked savings or other backup account. This acts as a safety net, ensuring you have sufficient funds available in your checking account to cover transactions.

Most banks offer this service, allowing you to specify the threshold amount that triggers an automatic transfer. For example, if your balance drops below $100, a pre-determined amount can be transferred from your savings account to cover the deficit. This prevents returned payments and overdraft fees.

Carefully consider the amount and frequency of these transfers to avoid depleting your backup account unnecessarily.

Choosing Accounts with No Overdraft Fees

One of the most effective ways to mitigate overdraft risk is to opt for a checking account that explicitly eliminates overdraft fees. These accounts typically decline transactions when available funds are insufficient, preventing you from incurring charges. Research different banks and credit unions offering these no-overdraft accounts.

Some institutions may offer “opt-in” overdraft protection for certain transactions, such as debit card purchases. Carefully consider whether this limited protection aligns with your spending habits.

Be sure to compare account features, including monthly maintenance fees, ATM access, and online banking capabilities to ensure the account meets your overall financial needs.

Building a Cushion Fund

A cushion fund acts as a safety net against unexpected expenses, preventing overdrafts. Consistently contributing a small amount to a separate savings account can build a substantial buffer over time.

Aim for a cushion fund that covers at least one month of essential expenses. This provides a financial buffer to handle unforeseen costs without relying on overdrafts. Even a small cushion can make a significant difference.

Automate regular transfers to your cushion fund. Set up a recurring transfer, even a small amount like $25 or $50 per week, to simplify the process and ensure consistent growth.

Contacting the Bank for Overdraft Reversals

If you incur an overdraft, contacting your bank swiftly is crucial. Explain the situation politely and inquire about the possibility of an overdraft reversal.

Some banks offer a grace period or may reverse the fee if it’s your first occurrence. Be prepared to provide details regarding the transaction and your account history.

While a reversal isn’t guaranteed, a proactive approach demonstrates responsibility and increases your chances of a favorable outcome. Maintain a respectful tone throughout the conversation.