Navigating the world of bank fees can be a daunting task, especially with the rise of digital banking alongside traditional accounts. Understanding the various fees associated with both digital and traditional bank accounts is crucial for making informed financial decisions. This article aims to provide a comprehensive overview of common bank fees, empowering you to minimize costs and maximize your financial well-being. Whether you’re considering opening a new account or simply want to better understand your existing one, understanding the fee structures of both digital and traditional banks is essential.

From monthly maintenance fees and ATM fees to overdraft fees and wire transfer fees, the landscape of bank fees can be complex. This article will delve into the specific fees commonly associated with digital accounts and traditional accounts, highlighting key differences and similarities. By gaining a clear understanding of these fees, you can make informed choices about the best banking option for your individual financial needs, minimizing unexpected costs and optimizing your financial resources. We’ll explore the intricacies of bank fees, providing clarity and actionable insights to help you navigate the complexities of digital and traditional banking.

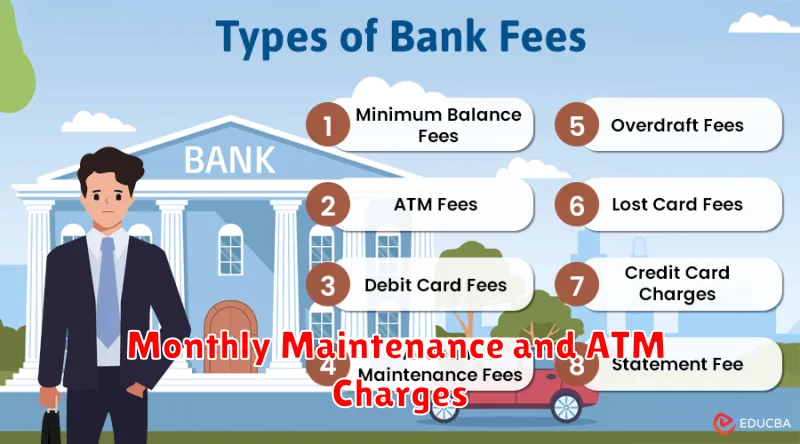

Types of Common Bank Fees

Understanding bank fees is crucial for managing your finances. Here are some common fees you may encounter:

Monthly Maintenance Fees: A recurring charge for having an account. Some banks waive this fee if you maintain a minimum balance or meet other requirements.

Overdraft Fees: Charged when you withdraw more money than you have available in your account.

ATM Fees: Fees for using ATMs that don’t belong to your bank’s network. These can include a fee from your bank and the ATM owner.

Non-Sufficient Funds (NSF) Fees: Similar to overdraft fees, these are charged when a check or payment bounces due to insufficient funds.

Why Digital Banks Often Have Lower Fees

Digital banks frequently offer lower fees compared to traditional banks. This is primarily due to their lower overhead costs. They lack the expenses associated with maintaining physical branches, such as rent, utilities, and staffing. These savings are often passed on to customers in the form of reduced or eliminated fees.

Additionally, digital banks often leverage technology to automate processes, further reducing operational costs. This efficiency contributes to their ability to offer more competitive pricing.

Monthly Maintenance and ATM Charges

Monthly maintenance fees are common charges for both digital and traditional accounts. These fees can often be waived by meeting certain requirements, such as maintaining a minimum balance or having direct deposit set up.

ATM fees vary depending on whether you use your bank’s ATM network or an out-of-network ATM. Using out-of-network ATMs often incurs two fees: one from your bank and another from the ATM owner. Digital banks sometimes offer rebates on these fees.

Avoiding Overdraft and Late Payment Fees

Overdraft fees occur when you withdraw more money than available in your account. To avoid these, monitor your balance regularly through online banking or mobile apps. Set up low-balance alerts to receive notifications when your funds are running low. Consider overdraft protection services, such as linking a savings account or credit card, to cover transactions exceeding your balance.

Late payment fees apply to missed credit card or loan payments. Avoid these by setting up automatic payments or calendar reminders. Ensure sufficient funds are available in your account on the due date. Contact your bank or lender immediately if you anticipate a late payment to explore possible options.

Comparing Fee Structures Between Banks

Understanding fee structures is crucial when choosing a bank account. Different banks employ varying fee models.

Some institutions charge monthly maintenance fees, while others waive them based on certain criteria like minimum balance requirements. Overdraft fees also differ significantly between banks, impacting the cost of accidentally exceeding your balance.

ATM fees can vary, especially for out-of-network transactions. Finally, consider potential transaction fees, particularly for international transfers or specific types of transactions.

Requesting Fee Waivers or Reductions

Don’t hesitate to negotiate with your bank regarding fees. Many banks are willing to waive or reduce certain fees, especially for loyal customers or those who maintain a minimum balance.

Be prepared to explain your reasoning for the request. For example, if you’ve experienced a temporary financial hardship, or if you’re considering switching banks due to high fees, politely communicate this to a customer service representative. Being proactive and demonstrating a willingness to work with the bank can often lead to a positive outcome.

Monitoring Fee Changes in App Notifications

Staying informed about fee changes is crucial for managing your finances. Mobile banking apps often provide a convenient way to monitor these changes.

Enable push notifications related to account activity. This allows you to receive real-time alerts about potential fee adjustments.

Regularly review your account statements within the app. Banks typically highlight fee changes in these statements.