Building a strong credit history is crucial for financial success, opening doors to better loan rates, higher credit card limits, and even improved rental application approvals. Traditionally, building credit has relied on established financial institutions. However, the rise of digital banks presents a new avenue for establishing and improving credit. This article will explore effective strategies for building credit utilizing the innovative tools and services provided by digital banks. Learn how you can leverage digital banking to enhance your creditworthiness and unlock financial opportunities.

Many individuals struggle with how to build credit, especially if they are new to the credit system or have experienced past credit challenges. Digital banks can offer accessible solutions for individuals looking to build or rebuild their credit. By understanding how digital bank accounts, secured credit cards, credit builder loans, and credit reporting practices interact, you can leverage these tools to your advantage. This comprehensive guide will equip you with the knowledge and resources to navigate the process of building credit with digital banks, taking you step-by-step through the most effective methods to achieve a healthy credit score.

Understanding Credit Scores and Their Importance

A credit score is a numerical representation of your creditworthiness, summarizing your credit history. Lenders use this score to assess the risk of lending you money. Higher scores indicate lower risk, leading to better loan terms and interest rates.

Understanding your credit score is crucial for accessing financial products and services. A good score unlocks opportunities like lower interest rates on loans, higher credit card limits, and even better insurance premiums. Conversely, a poor credit score can significantly limit your financial options.

Do Digital Banks Help Build Credit?

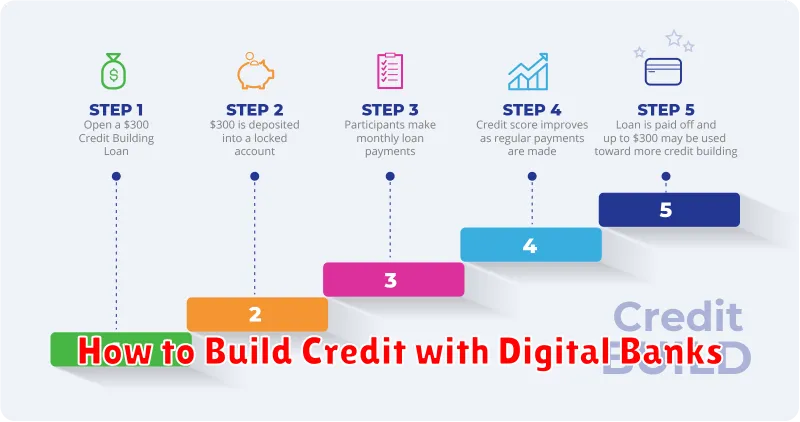

Yes, many digital banks offer products and services that can help you build credit. Traditional credit-building methods, such as secured credit cards and credit-builder loans, are often available through digital banking platforms.

These accounts are reported to the major credit bureaus, just like traditional banks. By using these products responsibly, making on-time payments, and keeping your credit utilization low, you can establish a positive credit history.

Using Secured Credit Products from Online Banks

Many online banks offer secured credit cards and secured loans, which are excellent tools for building credit. A secured credit card requires a cash deposit that acts as your credit limit. This minimizes the bank’s risk and makes approval easier. Similarly, a secured loan uses collateral, like a savings account, to guarantee repayment.

By making timely payments on these secured products, you demonstrate responsible credit behavior to credit bureaus. This positive payment history helps to establish your creditworthiness and improve your credit score over time.

Avoiding Common Credit Mistakes

Building credit requires responsible habits. Avoid maxing out your credit cards. High credit utilization negatively impacts your credit score.

Pay your bills on time, every time. Payment history is a crucial factor in credit scoring. Even one missed payment can significantly hurt your credit.

Don’t apply for too many credit accounts in a short period. Multiple applications can appear as a sign of credit risk.

Monitoring Your Credit via Mobile Apps

Digital banking often provides convenient credit monitoring tools directly within their mobile applications. These tools allow you to regularly track your credit score and review your credit report for any discrepancies.

Staying informed about your credit health is crucial for building good credit. Mobile apps provide real-time updates and alerts about changes to your credit profile, enabling you to address potential issues promptly. This proactive approach helps you understand the factors influencing your credit score and make informed financial decisions.

Paying on Time with Automated Reminders

Digital banks offer a range of tools to help you manage your finances and build credit. One of the most valuable features is automated payment reminders. These reminders can be set up through the bank’s app or website, and they notify you when a payment is due.

By enabling these reminders, you significantly reduce the risk of missing a payment, which is crucial for building a positive credit history. Missed payments can negatively impact your credit score, making it harder to obtain loans or credit cards in the future.

Customize your reminders to suit your preferences. Most digital banks allow you to choose the timing and frequency of alerts, ensuring you receive them with enough time to make the payment.

When to Move to Traditional Credit Products

Digital banking products are excellent tools for building initial credit. However, a robust credit profile often benefits from diversification. Consider transitioning to traditional credit products like credit cards or secured loans when you’ve established a positive payment history with your digital accounts. This usually translates to several months of on-time payments and a demonstrably increasing credit limit. Transitioning strategically allows you to access potentially lower interest rates, higher credit limits, and a wider range of financial products.