The future of banking is undeniably digital. Paperless banking, once a futuristic concept, is rapidly becoming the norm. This transformation is driven by a confluence of factors, including advancements in technology, evolving customer expectations, and the imperative for greater efficiency and reduced costs. From online account opening and mobile check deposits to digital loan applications and real-time transaction alerts, paperless banking solutions are revolutionizing how we interact with financial institutions. This shift towards a digital-first banking experience promises a more streamlined, accessible, and sustainable future for the financial industry.

This article explores the evolving landscape of paperless banking, examining the key trends shaping its development and the profound impact it has on both financial institutions and consumers. We will delve into the benefits of paperless banking, such as enhanced security, increased convenience, and environmental sustainability. Furthermore, we will address the challenges associated with this transition, including the need for robust cybersecurity measures and bridging the digital divide to ensure equitable access for all. Join us as we navigate the exciting trajectory of paperless banking and its implications for the future of finance.

What Is Paperless Banking?

Paperless banking refers to the digitalization of traditional banking services. It eliminates the need for physical paper documents like statements, checks, and deposit slips.

Instead, transactions and record-keeping are handled electronically. This shift towards digital banking offers convenience, efficiency, and often, enhanced security.

Customers can access their accounts, make payments, and manage finances through online platforms and mobile apps. This reduces paper consumption, benefiting both the customer and the environment.

Digital Statements and Contracts

A key component of paperless banking is the transition to digital statements and contracts. This shift eliminates the need for physical documents, reducing clutter and improving accessibility. Digital access allows customers to review their banking information anytime, anywhere.

Electronic signatures have become increasingly prevalent, making contract signing quicker and more efficient. This technology ensures legally binding agreements while contributing to a more sustainable banking practice by minimizing paper consumption.

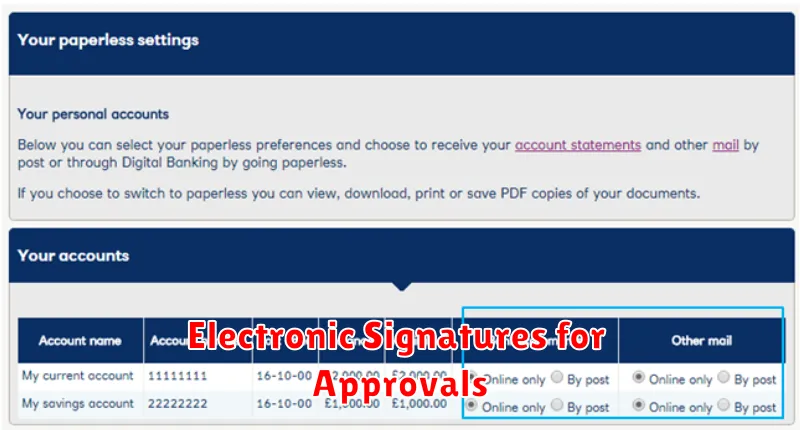

Electronic Signatures for Approvals

Electronic signatures are transforming approval processes in paperless banking. They offer a secure and efficient alternative to traditional wet-ink signatures, significantly reducing transaction times.

Customers can authorize transactions quickly and conveniently from anywhere, eliminating the need for physical paperwork. This streamlined process improves customer satisfaction and reduces operational costs for banks.

Electronic signatures also enhance security by providing audit trails and reducing the risk of fraud. The technology ensures the integrity and authenticity of documents, bolstering trust in digital transactions.

Eco-Friendly Benefits of Paperless Systems

Paperless systems offer significant environmental advantages. Reduced paper consumption directly translates to fewer trees being harvested, lessening deforestation and habitat destruction.

Furthermore, paper production involves substantial water and energy usage. Eliminating paper statements, receipts, and other documents minimizes these resource demands. Lower transportation needs for physical mail also decrease fuel consumption and greenhouse gas emissions.

Finally, reduced paper waste also contributes to less landfill burden, further minimizing environmental impact.

How Safe Are Your Digital Documents?

The security of your digital documents is a critical aspect of paperless banking. Financial institutions employ robust security measures to protect your information. These often include encryption, multi-factor authentication, and sophisticated fraud detection systems.

While these measures provide a high level of security, it’s essential to remain vigilant. Choosing strong passwords, being wary of phishing scams, and keeping your software updated are crucial steps in safeguarding your digital finances.

What to Do If You Need a Physical Copy

While paperless banking offers numerous advantages, there may be times when a physical copy of a document is required. If you need a printed statement or other banking record, there are typically several options available.

You may be able to download and print documents directly from your online banking portal. Alternatively, you can often request a physical copy through your bank’s website or mobile app. Some banks may also allow you to request documents by contacting customer service.

Be aware that there may be fees associated with requesting physical copies, especially for older records. Check with your bank for specific details and any applicable charges.

Global Trends in Fully Digital Banking

The global shift towards fully digital banking is accelerating, driven by evolving customer expectations and technological advancements. Mobile-first banking is becoming the norm, with customers managing their finances through smartphones and tablets.

Biometric authentication methods, such as facial recognition and fingerprint scanning, are increasing security and streamlining access. The rise of open banking, through APIs, is enabling greater financial transparency and personalized services.

Artificial intelligence and machine learning are being deployed to enhance fraud detection, personalize customer experiences, and automate processes. Cloud computing is providing the infrastructure for scalability and cost efficiency in digital banking.