In today’s fast-paced digital world, the demand for instant gratification extends to financial transactions. Real-time payment systems have emerged as a critical component of modern digital banking, revolutionizing how we send and receive money. This article will delve into the mechanics of these real-time payments, exploring their benefits, security considerations, and impact on the future of digital banking. Understanding the intricacies of real-time payment systems is essential for both consumers and businesses seeking to navigate the evolving financial landscape. We will cover key topics including the difference between real-time payments and traditional payment methods, the underlying technology that facilitates these instant transactions, and the various use cases driving their adoption.

Real-time payment systems, also known as instant payment systems, enable the immediate transfer of funds between accounts 24/7, 365 days a year. Unlike traditional methods that can take days to clear, real-time payments offer unprecedented speed and efficiency, making them ideal for time-sensitive transactions. This article will explore the advantages of leveraging real-time payment systems within digital banking, including improved cash flow management, reduced transaction costs, and enhanced customer satisfaction. Further, we will analyze the global implications of real-time payment systems and their potential to foster greater financial inclusion.

What Are Real-Time Payments?

Real-time payments (RTP) are electronic money transfers that occur immediately. The funds are available to the recipient within seconds of the payment initiation. This differs significantly from traditional payment methods, which can take several business days to clear.

These payments are typically initiated and settled 24/7/365, providing instant access to funds for both businesses and consumers. This immediacy is a key characteristic that distinguishes real-time payments from other forms of electronic transfers.

How They Differ from Standard Transfers

Real-time payments distinguish themselves from standard transfers in several key ways. Most notably, settlement and availability of funds are immediate. While standard transfers can take hours or even days to clear, real-time payments are credited to the recipient’s account instantly.

This immediacy impacts availability. Funds are immediately available for use upon successful transfer, unlike standard methods where funds might be held pending clearance. Furthermore, real-time systems often operate 24/7, offering continuous availability beyond traditional banking hours.

Benefits for Consumers and Businesses

Real-time payment systems offer numerous advantages for both consumers and businesses. Consumers benefit from the immediate availability of funds, facilitating faster transactions and eliminating the delays associated with traditional payment methods. This is particularly useful for time-sensitive payments like bill payments or person-to-person transfers.

Businesses experience improved cash flow management with real-time payments. The immediate confirmation of payment reduces uncertainty and allows for quicker reconciliation. Reduced processing costs are another key benefit, as real-time systems often eliminate the need for paper checks and manual processing.

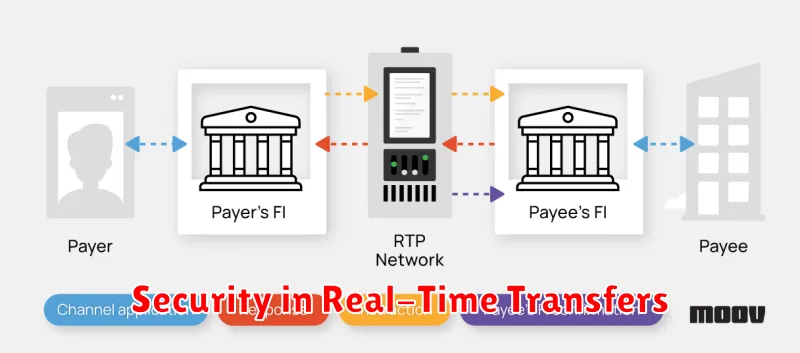

Security in Real-Time Transfers

Security is paramount in real-time payment systems. Encryption and multi-factor authentication are fundamental. Real-time systems employ robust fraud detection mechanisms that monitor transactions for suspicious activity.

Real-time fraud monitoring helps identify and prevent unauthorized access. These systems often incorporate behavioral biometrics and device identification to add extra layers of protection.

Top Countries Adopting the Real-Time Payment System

Several countries are leading the charge in real-time payment adoption. These nations have recognized the benefits of faster, more efficient payment processing for both consumers and businesses.

Some notable examples include:

- India: With its Unified Payments Interface (UPI), India has seen explosive growth in real-time transactions.

- China: China’s mobile payment systems, like Alipay and WeChat Pay, have become integral parts of daily life.

- South Korea: South Korea has long been a pioneer in real-time payments, with a robust and well-established infrastructure.

- United Kingdom: The Faster Payments Service in the UK has significantly modernized the country’s payment landscape.

These countries demonstrate the potential of real-time payment systems to transform economies and drive financial innovation.

Limitations and Transaction Caps

While real-time payment systems offer significant advantages, they are not without limitations. A key aspect to consider is the presence of transaction caps. These limits restrict the amount of money that can be transferred in a single transaction.

The specific cap varies depending on the system and the participating financial institutions. These limitations are often implemented for security reasons and to mitigate the potential impact of fraudulent activities.

The Future of Instant Payments

The future of instant payments is poised for significant growth. Driven by consumer demand for faster and more convenient payment options, real-time payment systems are expected to become increasingly ubiquitous.

Key developments include advancements in areas such as cross-border payments, integration with other financial services, and enhanced security measures. This evolution will likely lead to a more integrated and seamless financial ecosystem.

Innovation in areas like the Internet of Things (IoT) and blockchain technology will further shape the landscape of instant payments, enabling new use cases and driving further adoption.