In today’s increasingly digital world, online banking fraud is a significant concern. Protecting your financial security requires vigilance and understanding how to identify and report fraudulent activities. This article provides a comprehensive guide on how to report fraudulent activity in digital banking, empowering you to take swift action if you suspect your accounts have been compromised. Learning about the different types of fraud, such as phishing scams, unauthorized transactions, and identity theft, is crucial. Early detection and reporting are essential to minimizing potential losses and safeguarding your financial well-being.

Reporting fraud quickly and efficiently can make a significant difference in recovering lost funds and preventing further damage. This guide will outline the steps to take if you encounter suspicious activity, from contacting your bank or financial institution to filing a fraud report with the appropriate authorities. Understanding the procedures and having the necessary information readily available will streamline the process and help ensure a prompt resolution. Whether you’re dealing with credit card fraud, debit card fraud, or other forms of digital banking fraud, this article will equip you with the knowledge and resources to navigate the reporting process effectively.

Recognizing Signs of Digital Bank Fraud

Being aware of potential fraud is the first step to protecting your finances. Unusual Account Activity is a primary red flag. This includes unexpected withdrawals, deposits, or transfers you didn’t authorize.

Suspicious Emails or Texts are another common tactic. Be wary of messages requesting personal information like passwords or account numbers. Legitimate banks rarely request this information via email or text.

Unauthorized Login Attempts should also raise alarm. If you receive notifications about logins you don’t recognize, immediately change your password and contact your bank.

What to Do Immediately After Suspicion

If you suspect fraudulent activity in your digital banking account, taking swift action is crucial. Immediately change your password to a strong, unique one. Then, contact your bank through their official channels. Do not use contact information provided in suspicious emails or texts. Report the suspected fraud and provide any relevant details such as transaction dates, amounts, and descriptions.

Review your recent transactions carefully for any unauthorized activity. Keep records of any communication you have with your bank regarding the suspected fraud.

Contacting Your Bank’s Fraud Department

If you suspect fraudulent activity, contacting your bank’s fraud department immediately is crucial. Most banks provide multiple contact channels for reporting fraud.

Common methods include a dedicated fraud hotline, a secure messaging system within your online banking portal, or contacting your local branch directly. Be prepared to provide specific details about the suspected fraudulent transactions, such as date, amount, and merchant.

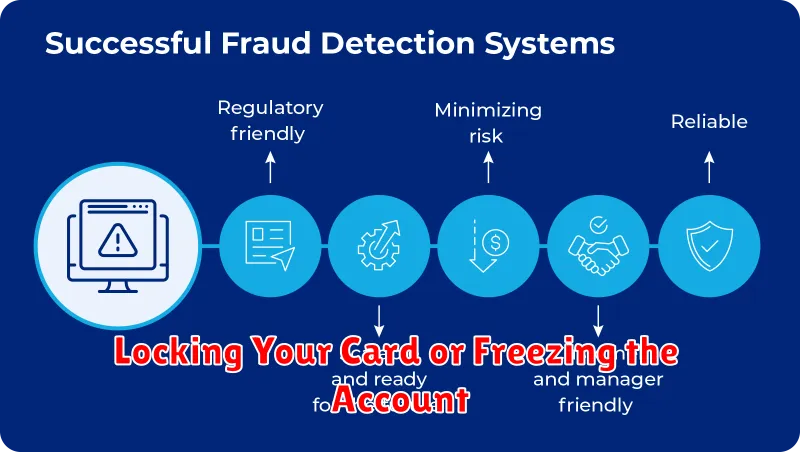

Locking Your Card or Freezing the Account

If you suspect fraudulent activity, taking swift action is crucial. One of the first steps you should consider is locking your card or freezing your account.

Locking your card prevents new transactions, while still allowing recurring payments and deposits to go through. This gives you time to assess the situation without completely cutting off access to your funds.

Freezing your account is a more drastic measure, halting all transactions, including deposits and withdrawals. Choose the option that best suits your needs and the severity of the suspected fraud.

Reviewing All Transactions for Irregularities

Regularly reviewing your digital banking transactions is crucial for detecting fraudulent activity. Look for any unauthorized transactions, even small ones. These could be a sign of a larger problem.

Pay close attention to unfamiliar merchants, unusual transaction amounts, and transactions occurring at odd times. If anything appears suspicious, immediately contact your bank.

Filing Reports with Financial Authorities

Reporting fraudulent activity to the appropriate financial authorities is a crucial step. This ensures a formal investigation can be launched and helps prevent further instances of fraud. Timely reporting is key to maximizing the chances of recovering lost funds and holding perpetrators accountable.

The specific authority to contact varies depending on your location and the nature of the fraud. In the United States, common authorities include the Federal Trade Commission (FTC), the Federal Bureau of Investigation (FBI)‘s Internet Crime Complaint Center (IC3), and your state’s Attorney General.

When filing a report, be prepared to provide detailed information about the fraudulent activity, including dates, times, transaction amounts, and any communication you’ve had with the perpetrators. Keep records of all supporting documentation.

Preventing Future Attacks with Safe Habits

Protecting your digital banking accounts requires proactive security measures. Strong passwords are essential, and using a unique password for each account is crucial. Enable two-factor authentication wherever possible for an added layer of security.

Regularly review your account statements for any unauthorized transactions. Be cautious of phishing scams and avoid clicking on suspicious links or providing personal information via email or text. Keeping your software and operating system up-to-date helps patch security vulnerabilities that attackers may exploit.