Managing finances effectively is a crucial life skill, and for students navigating the complexities of higher education or entering the workforce, it’s more important than ever. Digital banking offers a powerful suite of tools to help students take control of their money, budget wisely, and build a strong financial foundation. This article will explore practical tips and strategies on how students can leverage digital banking to achieve their financial goals, covering everything from budgeting and saving to managing expenses and avoiding debt.

From tracking spending with budgeting apps to setting up automatic savings plans, digital banking provides the accessibility and convenience students need to stay on top of their finances. Learn how to maximize the benefits of online banking, mobile payments, and other digital banking features to simplify money management and cultivate responsible financial habits. This guide will equip students with the knowledge and resources to make informed decisions, avoid common financial pitfalls, and build a secure financial future using the power of digital banking.

Why Digital Banking Works for Students

Digital banking offers numerous advantages for students managing their finances. Convenience is key, with 24/7 account access eliminating the need for in-person bank visits. This allows students to easily track spending, transfer funds, and pay bills from anywhere.

Cost-effectiveness is another significant benefit. Many digital banks offer fee-free checking and savings accounts, reducing financial burdens on students. Features like automatic budgeting tools and spending notifications empower students to cultivate healthy financial habits early on.

Choosing the Right Student-Friendly App

With a plethora of digital banking options available, selecting the right app is crucial. Look for apps specifically designed for students, often offering fee-free accounts and low minimum balance requirements.

Key features to consider include budgeting tools, savings goals, and spending trackers. These features empower students to monitor their finances effectively. Consider also the app’s user interface. A clean and intuitive design makes navigating finances simpler and less daunting.

Tracking Expenses with Budget Tools

Digital banking offers a variety of budgeting tools to help students track their spending. These tools often categorize transactions, allowing for a clear view of where your money is going.

Many apps provide visual representations of your spending habits, such as charts and graphs. This makes it easier to identify areas where you might be overspending.

Some tools also allow you to set budget limits for different categories. The app will then alert you when you are approaching or exceeding your pre-set limits, helping you stay within your budget.

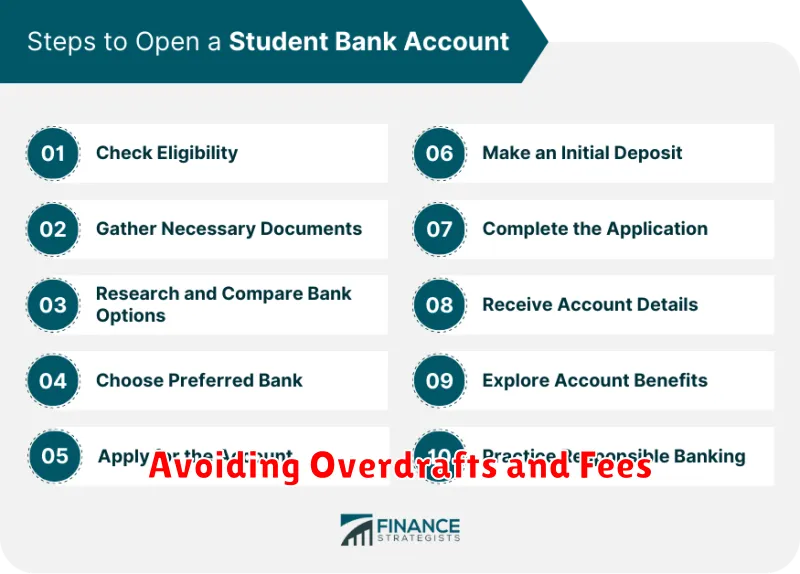

Avoiding Overdrafts and Fees

Overdraft fees can quickly deplete a student budget. Digital banking tools offer several ways to avoid these charges.

Set up low-balance alerts. Receive notifications when your account balance dips below a specified threshold. This provides a buffer to transfer funds or adjust spending.

Utilize budgeting tools. Many digital banking platforms include budgeting features. These tools help track expenses and provide a clear picture of your financial standing, making it easier to anticipate potential overdrafts.

Consider overdraft protection. Linking a savings account or credit card can cover overdrafts, though fees may still apply. Carefully review the terms and conditions of any overdraft protection service.

Setting Financial Goals in College

Setting financial goals is crucial for college students. It provides a roadmap for managing expenses and achieving financial stability. Start by creating a budget to track income and expenses.

Prioritize needs over wants. Needs include tuition, rent, and groceries. Wants are non-essential expenses like entertainment and dining out. Distinguishing between these helps allocate funds effectively.

Set short-term and long-term goals. A short-term goal might be saving for a textbook, while a long-term goal could be paying off student loans. Breaking down larger goals into smaller, achievable steps makes them less daunting.

Creating Emergency Savings

Building an emergency fund is crucial, especially for students. Unexpected expenses can and do arise. Aim to save three to six months of living expenses.

Start small. Even $10 or $20 a week adds up. Utilize digital banking tools to automate savings. Set up recurring transfers to a separate savings account.

Track your progress using budgeting features. Monitor your balance and adjust savings amounts as needed. An emergency fund provides a financial safety net, reducing stress during unforeseen circumstances.

Building Good Financial Habits Early

Developing strong financial habits during your student years is crucial for long-term financial well-being. Digital banking tools can assist in this process. Budgeting is a cornerstone habit. Track your income and expenses diligently to understand where your money goes.

Saving, even small amounts regularly, builds a financial safety net and fosters a saving mindset. Set realistic financial goals, whether it’s for a specific purchase or building an emergency fund. These practices create a foundation for responsible financial management throughout your life.